Congratulations to the newly married couple!

From this moment on, let us vow to cherish and keep each other, now and forevermore.

1. Do you possess a life insurance policy?

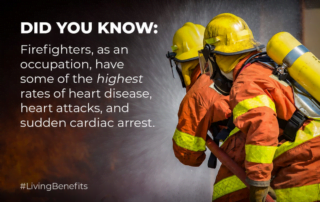

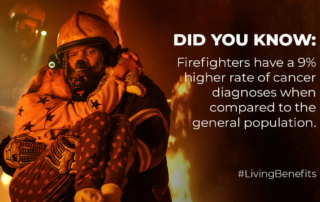

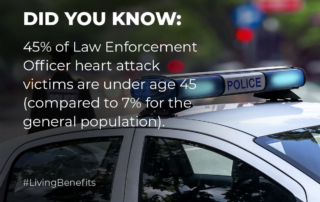

Starting any conversation about life insurance requires addressing this question first, so let’s tackle it head-on! Despite feeling invigorated after finding the love of your life, it’s important to acknowledge that no one is invincible. Life insurance offers numerous benefits such as safeguarding against income loss, covering funeral expenses, potentially gaining tax advantages, and providing early access to funds. The advantages you receive can vary depending on the type of life insurance you opt for. Ultimately, having life insurance is a fantastic way to demonstrate your love for your significant other, through the good times and the bad.

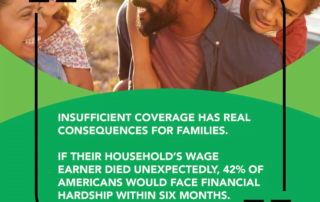

2. Are you adequately covered with the appropriate type and quantity of life insurance?

Life insurance policies are not a universal solution as they come in various types with different coverage, benefits, and applications. To ensure that your newly-wed spouse is adequately protected in the face of unforeseen events, it is crucial to obtain the right policy with sufficient coverage. This type of coverage not only covers loss of life, but also unexpected disabilities or long-term care needs. As your life with your spouse is unique, your life insurance policy will also be tailored to your individual needs, in sickness, and in health.

3. Are the beneficiaries on your policy correctly listed?

If you had a pre-existing policy prior to marriage, it is crucial to consider this question. Many newlyweds choose to designate each other as the main beneficiary, and for good reason: selecting the appropriate beneficiary can guarantee that any insurance benefits are paid to them, both in sickness and in health.

If you are unable to answer any of these questions in the affirmative, I invite you to reach out to me. Whether you are a newlywed or not, I would be delighted to provide you with a customized life insurance solution that can help you take care of each other until the end of your lives. I work with a variety of top-rated life insurance companies, including Direct Line Life Insurance, Globe Life Insurance, Gerber Life Insurance, New York Life Insurance, Protective Life Insurance, Churchill Life Insurance, American General Life Insurance, AIG Life Insurance, Colonial Penn Life Insurance, AAA Life Insurance, Liberty National Life Insurance, Banner Life Insurance, Transamerica Life Insurance, Guardian Life Insurance, AARP Life Insurance, Freedom Life Insurance, Global Life Insurance, Jackson National Life Insurance, MetLife Insurance, Principal Life Insurance, and more. If you are wondering how much life insurance you need, I can help you determine the appropriate coverage for your unique circumstances. And if you are looking for life insurance near you, I can assist you with that as well. So don’t hesitate to contact me to explore the different types of life insurance available, such as term life insurance, whole life insurance, and universal life insurance. Let me assist you with finding the best life insurance company that suits your needs, whether it’s Primerica Life Insurance, State Farm Life Insurance, Metropolitan Life Insurance Company, Northwestern Mutual Life Insurance, USAA Life Insurance, CMFG Life Insurance, or Prudential Life Insurance.