After experiencing significant events in life, such as marriage or the birth of a child, a considerable number of individuals opt to obtain life insurance:

- Getting married

- Buying a house

- Loss of a loved one

- The birth of a baby

Although it is possible to obtain life insurance after your baby is born or even during pregnancy (depending on the insurance provider), it is advisable to acquire life insurance before you start having children, or even before conception. This is the most prudent approach, rather than waiting until the baby is born or is on the way.

What is a compelling factor to obtain life insurance before welcoming a new member to the family?

Pregnancies may lead to complications for the mother, which can affect both her health and the results of her initial medical exam when applying for a policy. Insurance providers pay close attention to the following factors as potential warning signs:

- Preeclampsia (occurs in 5-10% of all pregnancies)

- Gestational Diabetes Mellitus (affects 9.2% of women)

- High cholesterol (rises during pregnancy and breastfeeding)

- A C-section (accounts for 32% of all deliveries)

Moreover, the benefit of being young is a compelling rationale to proceed and acquire life insurance for both parents.

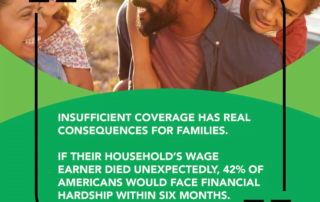

Securing life insurance at a young age and with good health makes it more affordable to pay lower premiums. This is an excellent way to plan for the future, especially when it comes to starting a family. By having a policy in place, your loved ones will be protected from the financial strain of any unforeseen and distressing life incidents.

If you are a new parent or are thinking of expanding your family, feel free to get in touch with me today. We can explore the possibilities of either opening a policy with ample coverage for your growing family or updating your existing one to include your new family member as a beneficiary.